Unknown Facts About Custom Private Equity Asset Managers

Wiki Article

The Best Guide To Custom Private Equity Asset Managers

(PE): spending in companies that are not publicly traded. Roughly $11 (http://go.bubbl.us/ddd0a6/87fd?/New-Mind-Map). There might be a few things you don't comprehend concerning the market.

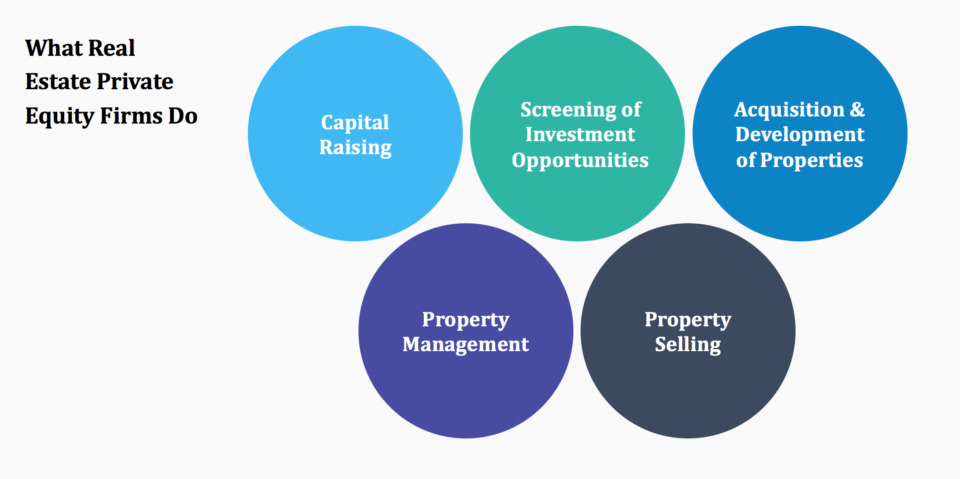

Companions at PE companies increase funds and handle the cash to produce beneficial returns for shareholders, usually with an financial investment horizon of between 4 and 7 years. Exclusive equity companies have a variety of investment preferences. Some are rigorous financiers or passive investors wholly depending on administration to grow the firm and generate returns.

Since the very best gravitate towards the larger deals, the middle market is a substantially underserved market. There are extra sellers than there are very skilled and well-positioned finance professionals with extensive customer networks and sources to handle an offer. The returns of exclusive equity are generally seen after a few years.

All about Custom Private Equity Asset Managers

Flying below the radar of large international firms, much of these tiny firms usually give higher-quality customer care and/or niche services and products that are not being used by the huge corporations (https://slides.com/cpequityamtx). Such upsides bring in the passion of exclusive equity firms, as they have the insights and wise to exploit such possibilities and take the company to the next degree

Most supervisors at profile companies are provided equity and benefit compensation structures that compensate them for striking their monetary targets. Exclusive equity possibilities are typically out of reach for people that can't spend millions of dollars, yet they should not be.

There are policies, such as limits on the aggregate quantity of money and on the number of non-accredited capitalists. The personal equity service brings in some of the find ideal and brightest in corporate America, consisting of leading performers from Fortune 500 business and elite management consulting firms. Law office can also be hiring premises for private equity employs, as accounting and lawful abilities are necessary to full bargains, and transactions are very demanded. https://www.pageorama.com/?p=cpequityamtx.

Not known Details About Custom Private Equity Asset Managers

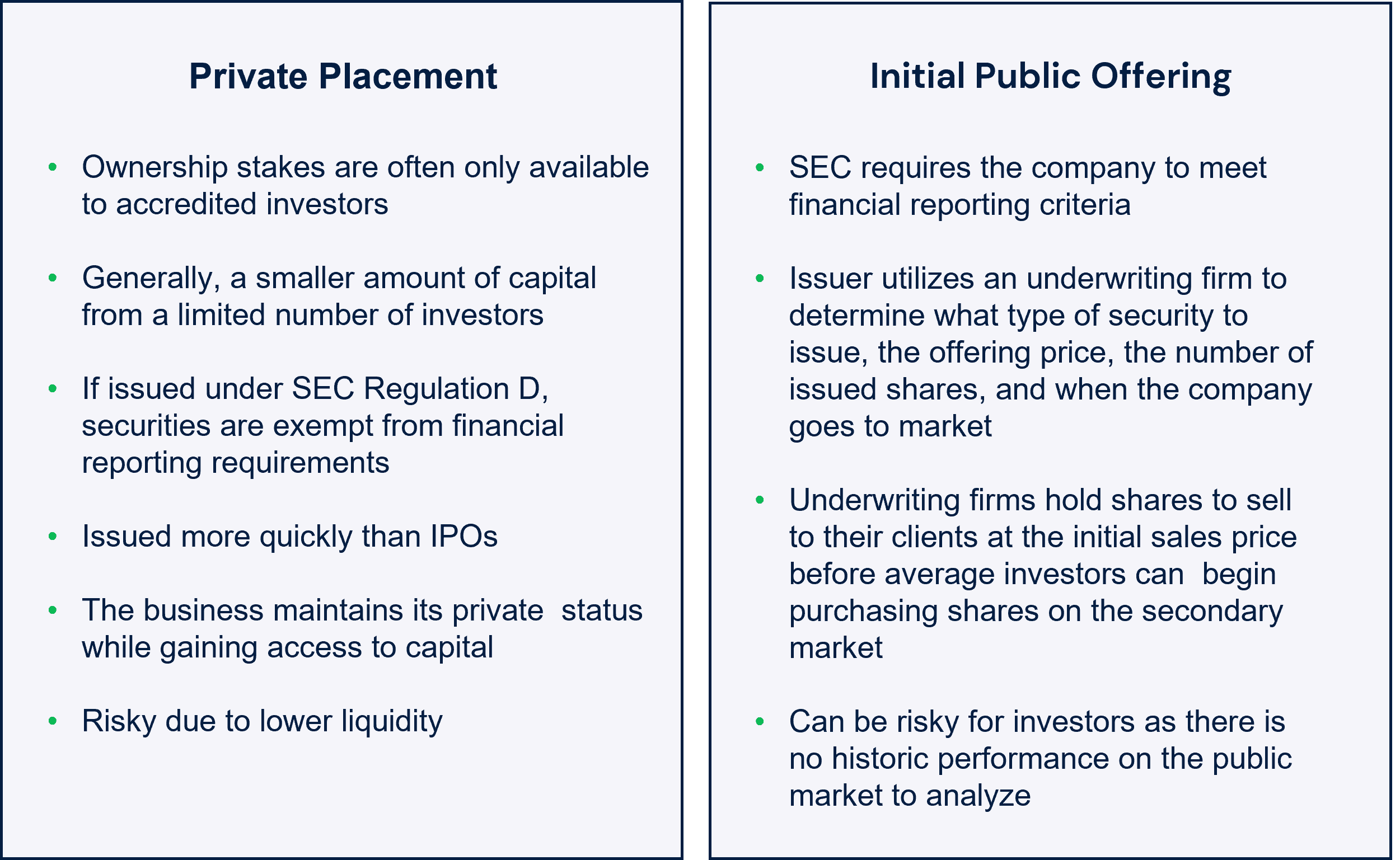

An additional disadvantage is the absence of liquidity; as soon as in an exclusive equity transaction, it is hard to leave or offer. There is an absence of versatility. Private equity likewise features high charges. With funds under management already in the trillions, private equity firms have actually become eye-catching investment automobiles for rich individuals and organizations.

Now that access to exclusive equity is opening up to even more private capitalists, the untapped capacity is coming to be a reality. We'll begin with the primary arguments for investing in private equity: How and why exclusive equity returns have actually traditionally been greater than various other properties on a number of degrees, Just how consisting of personal equity in a portfolio influences the risk-return profile, by aiding to diversify against market and intermittent risk, After that, we will detail some essential factors to consider and threats for personal equity financiers.

When it involves presenting a new asset into a profile, one of the most fundamental factor to consider is the risk-return account of that possession. Historically, exclusive equity has actually shown returns similar to that of Emerging Market Equities and more than all other conventional asset courses. Its relatively low volatility coupled with its high returns makes for a compelling risk-return profile.

The Main Principles Of Custom Private Equity Asset Managers

Private equity fund quartiles have the best range of returns throughout all different asset courses - as you can see listed below. Methodology: Inner price of return (IRR) spreads out calculated for funds within vintage years individually and afterwards balanced out. Typical IRR was computed bytaking the standard of the average IRR for funds within each vintage year.

The takeaway is that fund option is vital. At Moonfare, we accomplish a stringent choice and due persistance procedure for all funds noted on the platform. The result of including personal equity into a portfolio is - as always - depending on the portfolio itself. A Pantheon research from 2015 recommended that including personal equity in a profile of pure public equity can unlock 3.

On the various other hand, the finest personal equity companies have accessibility to an also larger pool of unknown opportunities that do not face the very same scrutiny, in addition to the resources to perform due diligence on them and identify which are worth purchasing (Syndicated Private Equity Opportunities). Spending at the first stage suggests greater threat, but also for the companies that do prosper, the fund gain from greater returns

The Main Principles Of Custom Private Equity Asset Managers

Both public and personal equity fund supervisors devote to spending a percentage of the fund but there continues to be a well-trodden concern with lining up passions for public equity fund management: the 'principal-agent issue'. When a capitalist (the 'primary') employs a public fund manager to take control of their capital (as an 'agent') they delegate control to the manager while preserving ownership of the possessions.

When it comes to private equity, the General Companion does not simply make a management charge. They also earn a percentage of the fund's revenues in the type of "bring" (typically 20%). This guarantees that the passions of the supervisor are aligned with those of the investors. Personal equity funds also minimize an additional form of principal-agent problem.

A public equity financier eventually desires one point - for the management to enhance the stock cost and/or pay out returns. The financier has little to no control over the choice. We showed over the amount of private equity methods - particularly majority acquistions - take control of the running of the business, guaranteeing that the long-term value of the firm comes first, raising the return on financial investment over the life of the fund.

Report this wiki page